More Good News on Inflation

In my post on the CPI numbers from one month ago, I argued that the data on inflation was better than most news reports suggested. When inflation is falling, the average rate over the last 12 months – the type of measure that government officials and news reports tend to emphasize – give us an indication of the current rate of inflation that is biased upward.

When I wrote last month, I said that it is not hard to imagine that the fight against inflation could be over soon. The data for December provide additional support for this optimistic assessment, but they do bring into sharper focus the question of when we should declare victory. What should the new target rate of inflation be?

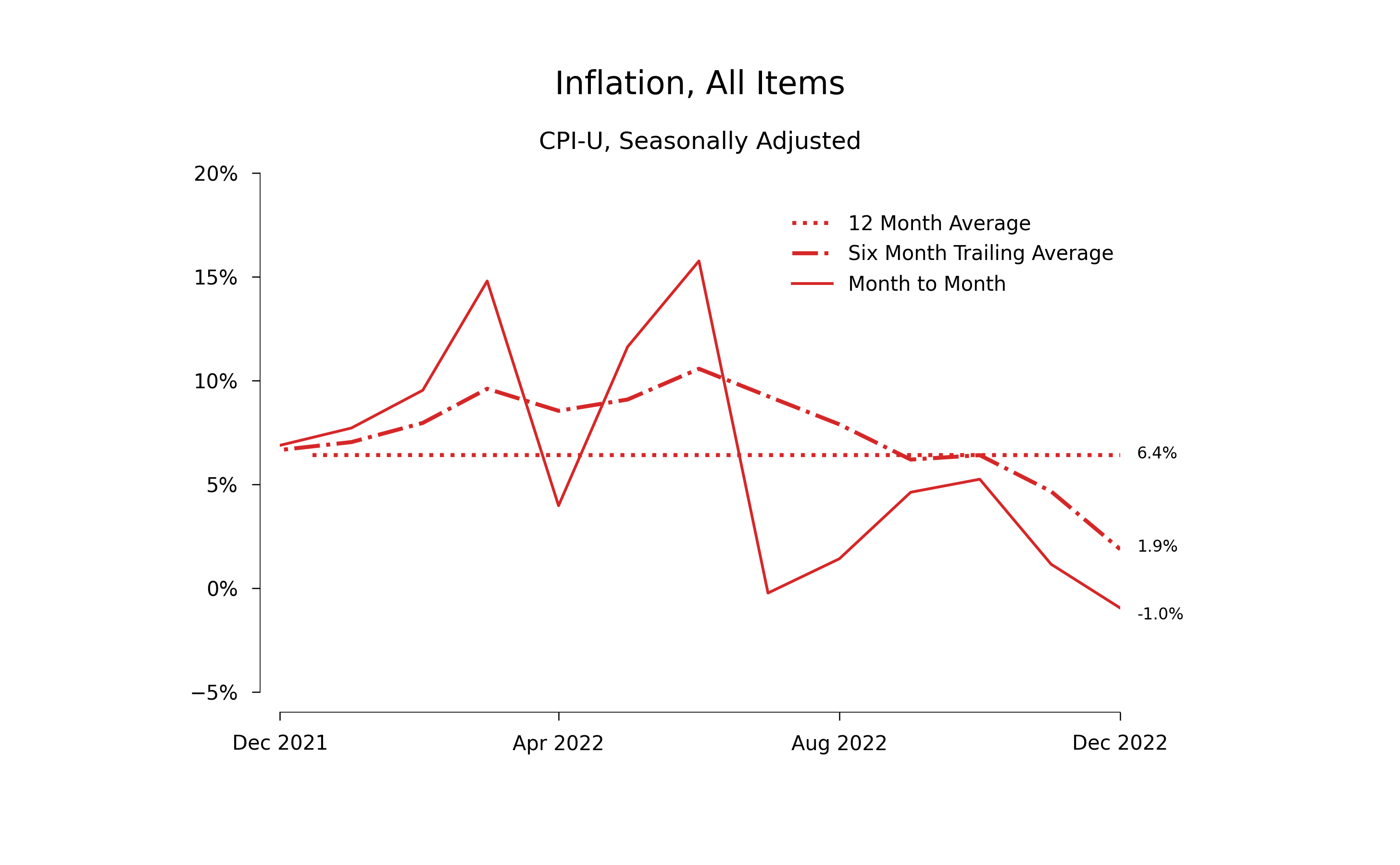

Updated Graph for CPI Inflation - All Items

Compare this graph of price for all items with the one from the previous post. The current monthly rate of inflation is far below the 6-month average and the 12-month average. Updated to include the results for December, all three rates are lower:

All Items: Change from November to December

$$\text{12 month:\ \ \ } 7.1\% \rightarrow 6.4\%$$

$$\text{6 month:\ \ \ } 4.7\% \rightarrow 1.9\%$$

$$\text{1 month:\ \ \ } 1.2\% \rightarrow -1.0\%$$

Falling energy prices are contributing a lot to the fall in the all items price index. For all other items, the rate of inlation in December was higher by about 1 percentage point than in November. As I emphasized in the last post, there is noise in the monthly data. The results will bounce up and down. Nevertheless, it is clear that even for the price index that excludes food and engergy, over the last three months of 2022, prices increased at an annual rate that is less 4%:

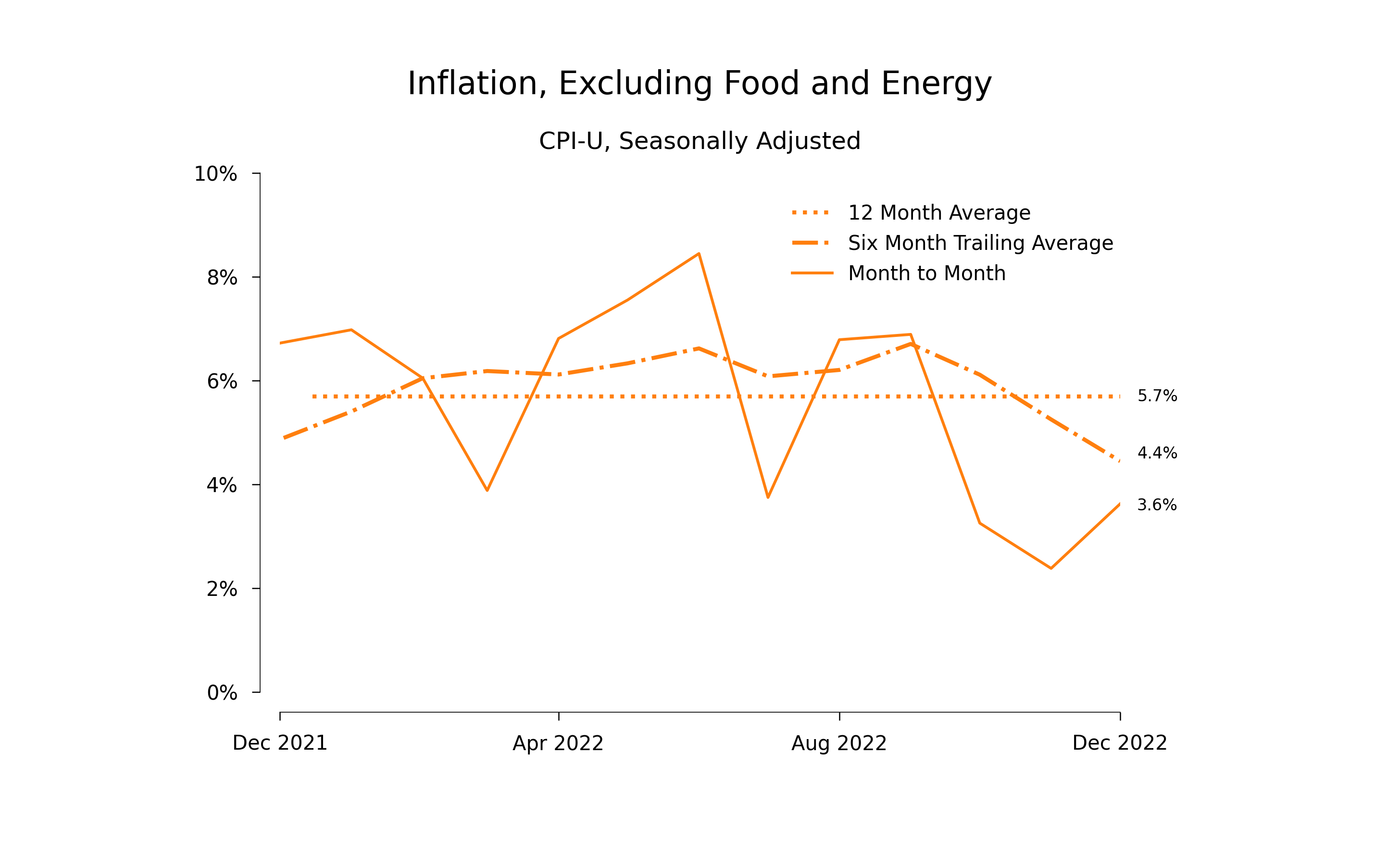

Updated Graph for CPI Less Food and Energy

Less Food and Energy: Change from November to December

$$\text{12 month:\ \ \ } 6.0\% \rightarrow 5.7\%$$

$$\text{6 month:\ \ \ } 5.3\% \rightarrow 4.4\%$$

$$\text{1 month:\ \ \ } 2.4\% \rightarrow 3.6.\%$$

The New Target Rate of Inflation

Recall that in the wake of the financial crisis, the consensus was clearly that a target rate of inflation equal to 2% was dangerously low. I’m not aware of any persuasive argument that identified flaws in the reasoning behind that consensus, or even of any feeble argument along these lines. The public debate now seems simply to be that it is OK now to pretend that the financial crisis never happened.

A more charitable interpretation is that economists who study monetary policy are convinced that the era of abnormally low real interest rates is behind us and that voicing support for a return to the 2% target rate is politically acceptable way to make the transition to the inevitable outcome – permanently higher nominal rates.